Just what Is a Gold individual retirement account and also How Does It Function? Advantages, Disadvantages, and A lot more

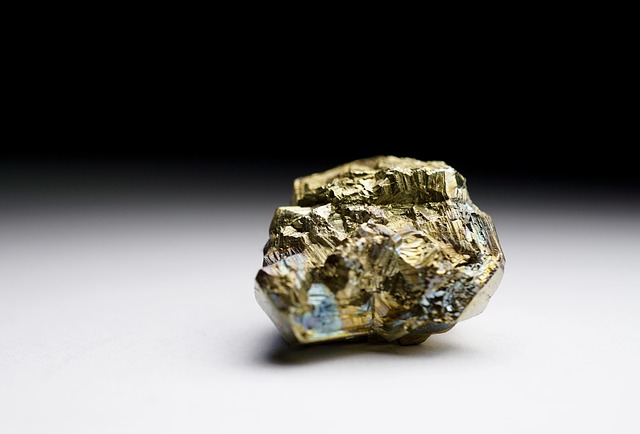

When many people take into consideration buying gold, they quickly think of gold coins or bars. Lots of capitalists, nonetheless, are amazed to learn that they can save for retired life by acquiring gold in a tax-advantaged gold individual retirement account.

Opening up a pension backed by gold, silver, and other rare-earth elements is an exceptional method to guarantee your retirement safety, also when rising cost of living climbs. Gold IRA supply a safe, clear choice to offset your yearly tax liability while buying a tax-free asset up until retirement.

We have actually assembled this post to aid financiers comprehend even more concerning this safe-haven property. It will educate you all you need to find out about what a gold individual retirement account is, exactly how a gold-backed IRA works, as well as how you can begin getting gold in an individual retirement account.

Just what Is a Gold individual retirement account?

A gold individual retirement account is a self-directed individual retirement account in which you can buy gold and also other rare-earth elements.

The identifying feature of gold IRAs is that they enable capitalists to acquire and possess precious metals straight, instead of indirectly, similar to an ETF. Opening up a gold IRA account enables you to acquire gold in different kinds, such as bullion, coins, as well as bars. You can likewise buy various other important precious metals such as silver, palladium, and platinum.

In the USA, rising cost of living has actually reached historic highs, prompting customers to reassess dollar-backed investment alternatives and also reorganize their finances. As a matter of fact, the consumer price index enhanced by 9.1% in June 2022 contrasted to June 2021.

The properties in your regular retirement accounts will certainly decline as inflation increases. Gold as well as rare-earth elements, unlike conventional paper assets, often expand in worth as rising cost of living increases as a result of boosting need.

Consequently, numerous financiers have begun diversifying their retirement portfolios by supplementing standard supplies and bonds with gold-backed Individual retirement accounts.

Who Is In Charge Of A Gold Ira?

For a gold individual retirement account, you can not use the exact same custodians as you would certainly for typical individual retirement accounts. Rather, you should situate a company or custodian that is experts in gold IRA accounts, as they should be kept apart from common Individual retirement accounts, need numerous paperwork, and follow rigorous coverage regulations.

Gold IRA custodians assist account owners in organising documents for purchases and tax obligation coverage while making sure all internal revenue service guidelines are pleased.

Custodian services aid with gold storage space in addition to assuring IRS conformity. When you buy a gold individual retirement account, you can not legally maintain your gold at home. You should discover an IRS-approved storage space facility.

How Do I Put Cash Into a Gold IRA?

A gold IRA can be funded in a variety of methods. Rolling over an existing individual retirement account, 401( k), or various other pension is one of the most typical techniques to start. This is prominent for those that have a well-known retirement account from a former business and wish to access the properties without sustaining any kind of withdrawal charges.

If you don’t have an existing account to roll over, you can money the acquisitions by moving cash to your account via ACH. Your payments to your retirement account will likewise decrease your taxable income for the year, up to the internal revenue service limitations.

After funding your account, you can begin buying as well as marketing rare-earth elements within your individual retirement account. The internal revenue service allows gold IRA account holders to buy a wide range of bullion, bars, or coins in the account. Keep in mind that you can not contribute gold that you currently have to your IRA, so maintain that in mind while making your financing alternatives.

Can I Only Purchase Gold Through A Gold individual retirement account?

One of the most popular myths about gold IRAs is that the account is just for gold. You can, nonetheless, invest in other alternative properties such as silver, platinum, and palladium when you begin a rare-earth elements IRA with a business like Noble Gold Investments.

Nevertheless, in order for precious metal bullion to be consisted of in your individual retirement account, it must be determined as “IRA-compatible” or “IRS-approved” when purchased. Some business make this procedure much easier by just offering bullion with these labels.

In addition, when acquiring gold bars, capitalists need to utilize care. Financiers can just purchase gold bars with a minimal purity of 99.5%, according to IRS requirements.

Just How Is Individual Retirement Account Gold Stored?

In contrast to standard gold and silver purchases, you can not keep your individual retirement account gold at home; instead, your custodian needs to maintain it in an IRS-approved facility.

When evaluating different gold IRA companies, look into the depository they utilise to store your gold and where it is located. Generally, your funds will certainly be held in national depositories, certified third-party trustees, or banks that supply gold individual retirement account storage space services. Even more details on our safe gold vault can be located here.

You will face a tax fine if you keep your precious metal financial investments in the house. When you open your gold IRA, your custodian will certainly refer you to a storage facility, making it simple for you to be IRS-compliant.

The Gold IRA Withdrawal Method

Along with adhering to yearly payment restriction needs, bear in mind that withdrawals from your account are not allowed until you get to the age of 59 1/2. Or else, your withdrawals will certainly be punished by an additional 10% tax.

If you maintain your account possessions in your home, the IRA will certainly consider it a withdrawal, as well as you will need to pay the extra 10% tax if you are under the called for age. When you start your gold IRA account, your custodian will assist you in making clear the withdrawal laws and also needs.

Taking out from your gold individual retirement account works similarly to withdrawing from a conventional individual retirement account after you get to retirement age. As you prepare to liquidate your properties, you log right into your account and place a sell order for a specific amount of gold. You can take out cash from your account in United States bucks as soon as this order has cleared.

Ensure the Safety And Security of Your Golden Years – Open Up a Gold-Backed Individual Retirement Account (INDIVIDUAL RETIREMENT ACCOUNT) Today.

Gold-backed Individual retirement accounts offer numerous advantages to those desiring to diversify their profiles as well as protect their retirement funds from rising cost of living. Precious metals have a phenomenal potential to hold value as a safe house investment, also during financial or social crises.

If you prepare to start a gold IRA or want to chat with somebody who can give more details, phone call Noble Gold Investments at 877-646-5347 promptly. We are just one of the market’s biggest and also most trusted gold IRA companies, and our professionals can answer any kind of questions you have relating to purchasing rare-earth elements in an individual retirement account.